By Rebecca Styles

Research Lead | Hautū Rangahau

Australia’s proposed supermarket reforms are bold and wide ranging. How do New Zealand’s reforms measure up?

The Australian Senate Select Committee on Supermarket Prices has come out strong with bold plans to make supermarket shopping fairer for consumers.

We look at the Australian reforms and compare them with New Zealand’s shake up of the supermarket sector.

We think the government needs to take bold and decisive action to reform the grocery sector. A slow and steady pace isn’t helping New Zealanders save at the till.

How does it stack up against grocery reforms in Aotearoa

The Senate Select Committee on Supermarket Prices and market power of major supermarkets has come out with 14 recommendations to ensure grocery prices are fair for consumers.

Back in March 2022, New Zealand’s Commerce Commission released its report into the factors that affect competition in the grocery sector, along with its recommendations for change.

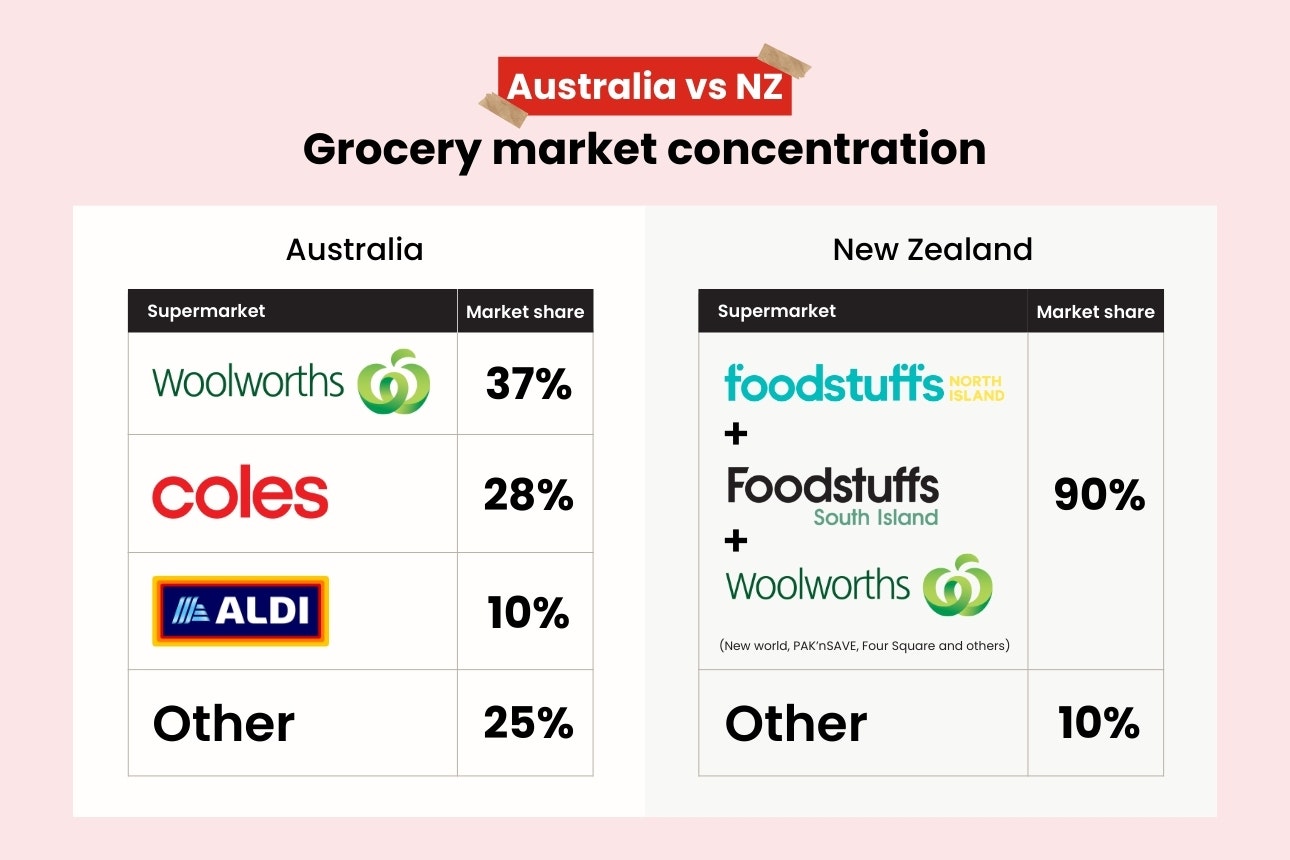

New Zealand’s grocery sector is more concentrated than Australia. The big two supermarkets in Australia have about 65% market share, while the duopoly here has about 90%.

Two major differences in the recommendations are that the Australian select committee wants to make price gouging illegal, as well as introduce divestiture laws to create powers to break up Australia’s major players if they misuse their market power.

While divestiture was considered by the Commission’s market study, it wasn’t recommended because the cost may have outweighed any benefit. We think this should be considered again, along with a ban on price gouging.

Australia also wants the competition watchdog to investigate and prosecute unfair trading practices. We’d like to see it introduced here, too.

The Grocery Commissioner Pierre van Heerden says the Australian report shows how far ahead New Zealand is in its grocery reforms. In his May newsletter, van Heerden notes New Zealand’s Grocery Supply Code is mandatory, while the Australian version is voluntary.

However, the Senate enquiry recommends it become mandatory by the 30 September 2024. This is faster than the New Zealand equivalent, which took 18 months to implement after the release of the Commission’s market study.

Stronger rules on pricing practices

The Senate report also recommends unit pricing and standardised pricing across supermarkets.

Unit pricing is due to be in place in most supermarkets here by 31 August (but not online). There are also guidelines about how clear and legible unit pricing should be.

Despite progress on unit pricing, general pricing and promotional practices remain a big issue at the supermarkets.

In June 2023, we lodged a complaint about dodgy specials at supermarkets that we think are potential breaches of the Fair Trading Act. The Commission is currently investigating the complaint.

We’d also like to see a stop to two-tier pricing for members and non-members of loyalty schemes.

Merger reform to ensure a competitive market

The Australian report also recommends merger reform to ensure one or two players can’t dominate the market. Robust merger rules mean the marketplace is competitive for consumers. While mergers weren’t explicitly covered in the Commission’s report, there are already robust laws about mergers in New Zealand.

These laws are pertinent now given Foodstuffs wants to merge its North and South Island operations.

The Commission has identified potential competition issues from its initial investigation of the proposed merger.

“We are not yet satisfied that the proposed merger would not substantially lessen competition,” the Commission said.

A final decision is due on the 31 May 2024.

Laws about land banking

The Australian report also wants the competition watchdog to investigate and stop land banking by supermarkets.

Back here, legislation passed in 2022 to stop supermarkets placing restrictive covenants on land use and exclusivity covenants in leases.

Covenants have been used by both supermarket giants to restrict competitors setting up stores nearby.

The Commission’s market study in the grocery sector found retailers used more than 190 covenants on land, or in leases, to limit the availability of sites for competitors.

These covenants should never have been allowed. They restrict competition, which limits consumers’ abilities to shop around for a better range of products at better prices.

Food waste and safety of supermarket employees

The Australian Senate select committee also investigated the food waste created by the supermarket sector and recommended an update to the national waste strategy.

New Zealand’s waste strategy is managed by the Ministry for the Environment. It's working with households and businesses to prevent and reduce food waste.

Another recommendation was to ensure the health and safety of supermarket employees and protect them from customers.

Back here, facial recognition technology is being trialled at selected Foodstuffs North Island stores for crime prevention, and to keep supermarket employees and shoppers safe. While we think the health and safety of supermarket employees and shoppers is paramount, we have concerns that the technology is more about preventing shoplifting than keeping people safe.

The Privacy Commissioner has started an inquiry into the used of facial recognition technology at Foodstuffs supermarkets to see whether the use of the technology is justified.

We’ve also seen reports of Woolworths supermarkets trialling body cams on staff.

Global manufacturers and big box retailers

The global food manufacturers didn’t provide information to the Senate hearing in a timely way, so the committee is taking more time to consider this feedback.

Here, the Grocery Supply Code of Conduct was put in place to address the power imbalance between the supermarkets and suppliers.

The Senate also wants to look further into the role of big box retailers who are starting to sell traditional grocery items.

Back here, The Warehouse has started selling grocery items and is finding it difficult to get a foothold in the grocery sector.

Last year, it ran into problems stocking Sanitarium Weet-bix, yet the Commission dismissed its complaint because the supply disruption was for a short period.

The Warehouse Group CEO Nick Grayston said its grocery share is about 3% of the New Zealand market.

“While we’re working hard to create change, when people talk about us as the third player it gives you a real sense of the size of the challenge ahead. The stranglehold the big supermarkets have in New Zealand ultimately comes at the expense of affordable groceries. Both customers and regulators are questioning whether the status quo is the right approach, and we think there is more work to do in New Zealand. We’ll be watching the Australian review with interest.”

We need new players to enter the market so New Zealanders have access to lower food prices during the cost-of-living crisis.

Next steps for the NZ grocery sector

In the Grocery Commissioner’s upcoming review, coming mid-year, it will evaluate how competitive the supermarket sector is 2 years after the market study.

"To date, the approach towards our supermarket sector has been soft and steady. We have a commissioner, a new grocery code of conduct, and a progress report on the cards. Yet, with the level of financial food stress at the checkout at an all time high, we can't afford meandering progress - which is what is currently happening,” said Gemma Rasmussen, Consumer head of research and advocacy.

“We urge the New Zealand government to take a close look at the Senate Select Committee report and consider what it can learn from the bold and decisive recommendations.”

Make supermarkets price it right

Find out about our campaign to tell the government we need clear rules, stronger penalties and automatic compensation for shoppers.

Comments

Was this page helpful?

Related articles

Are we any closer to solving the supermarket duopoly problem?

Kiwis leaving for Australia: Is it really the promised land?

Supermarket loyalty pricing: Why are member and non-member prices so different?