We’ve come a long way since 1959. But our stock in trade hasn’t changed – whether it’s exposing dodgy dealers or giving you the lowdown on products that go the distance.

April 2001: Daylight robbery

We uncovered big differences in house and contents premiums – the most expensive contents insurance policy for a young person was almost two-and-a-half times the price of the cheapest! Our advice: shop around – and if you found a lower quote, ask your insurer to do better. We also recommended upping your excess to make premiums cheaper and looking out for multiple policy discounts. Some companies also offered discounts for burglar alarms, as well as no-claims bonuses.

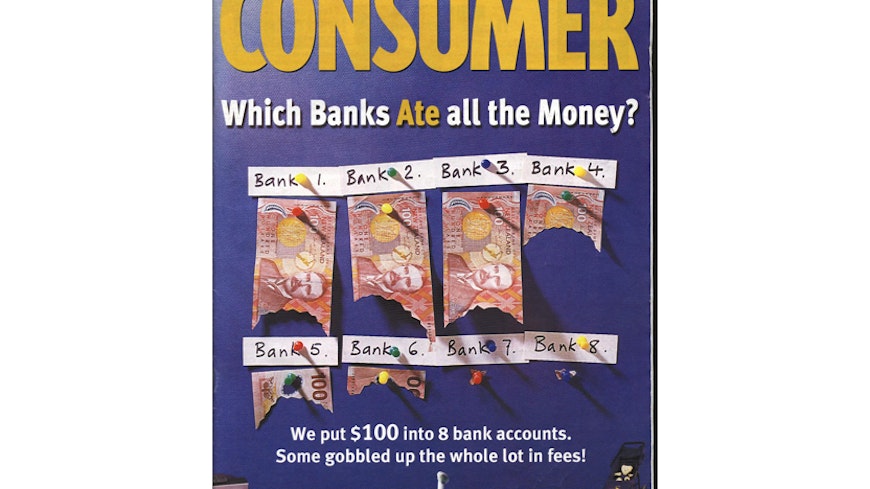

October 2001: Greedy banks

Bank fees were chewing through customers’ cash. A Consumer staff member set up a cheque account at eight banks. He put $100 in each account with four $10 deposits going in and four $10 automatic payments going out each month. After a year, three accounts had about $80 in them while three others had less than $40. Two banks – ANZ and BNZ – had gobbled up all the money and continued to take out fees, leaving the accounts in the red.

September 2002: Cleaned out

It was the worst case of door-to-door sales sleaze we’d seen in years. Vacuum cleaner seller Filter Queen International was flogging vacs for a whopping $8600 ($12,032 in today’s prices), signing up vulnerable consumers on hire purchase deals. The company would put courier-style cards in letterboxes about a delivery or phone about a “prize”. What you got was a two-hour sales pitch about a grossly overpriced vacuum. We made a complaint to the Commerce Commission and warned readers not to be taken in.

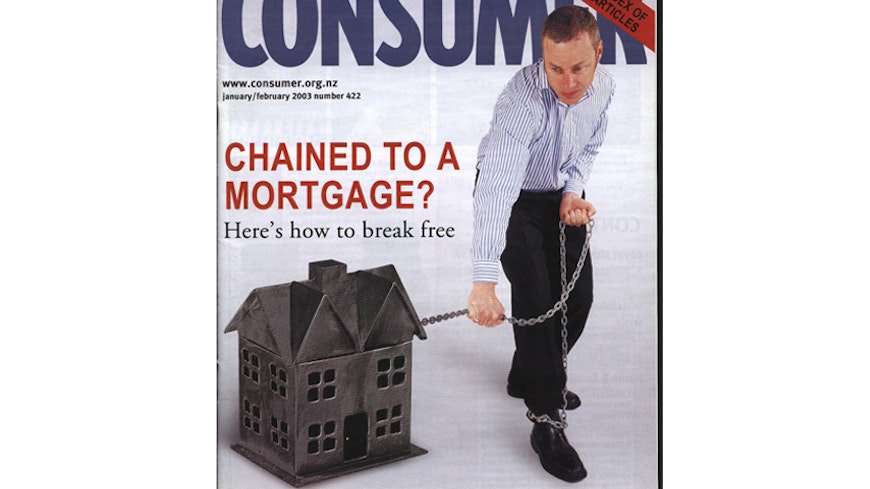

Jan/Feb 2003: Chained to the mortgage

Our “12-step mortgage reduction plan” gave consumers the lowdown on how to be mortgage-free faster and avoid years of debt. We took a couple with a $135,000 mortgage and saved them $40,000, reducing their mortgage term by five-and-a-half years. We cautioned consumers to check their statements: we’d heard of banks charging the wrong interest rate and failing to follow instructions to maintain repayments when interest rates fell, resulting in customers paying much more than they should.

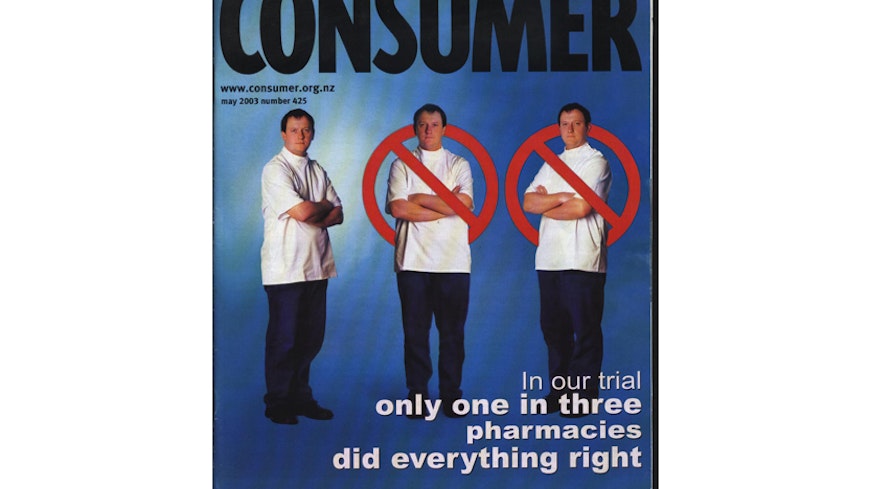

May 2003: Reliable professionals?

Our mystery shop of 27 pharmacies found only half asked enough questions of our shopper to ensure the medicine she asked for was appropriate. Seven didn’t even ask why she needed it and four failed to comply with their legal obligations for selling prescription-only medications. Just nine pharmacies got everything right, including advising on how to use the medicine and what to do if it didn’t work.

July 2003: Breakfast candy

We checked the nutritional value and price of 181 breakfast cereals and were gobsmacked by the sugar content of many, especially those marketed to children and sportspeople. Five of the cereals marketed to kids were at least half sugar! For a better start to your day, we recommended rolled oats, wheat biscuits or cornflakes.

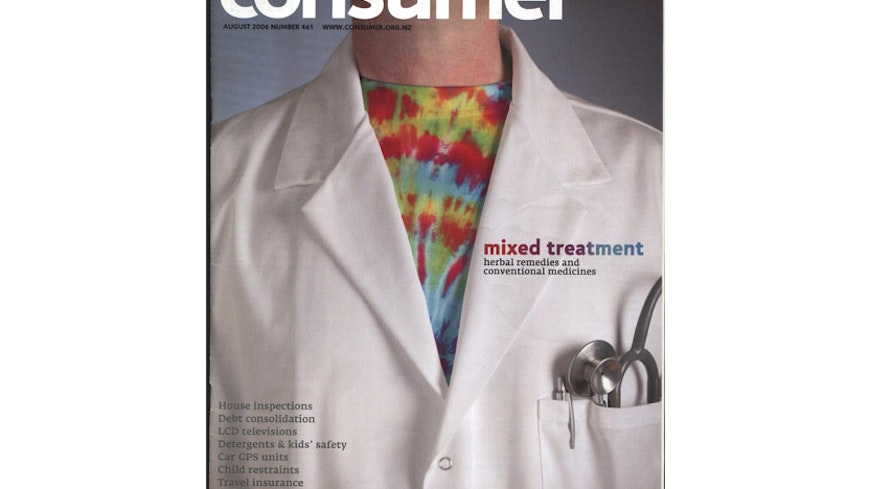

August 2006: Safe alternative?

After 13 herbal medicines were found to be contaminated with prescription drugs – including Reductil and Viagra – we turned the spotlight on alternative medicines. Given the potential harm these products could do, we wanted them to be tested with the same rigour applied to other medicines. We also wanted manufacturers to be held to account and substantiate the claimed benefits of their products.

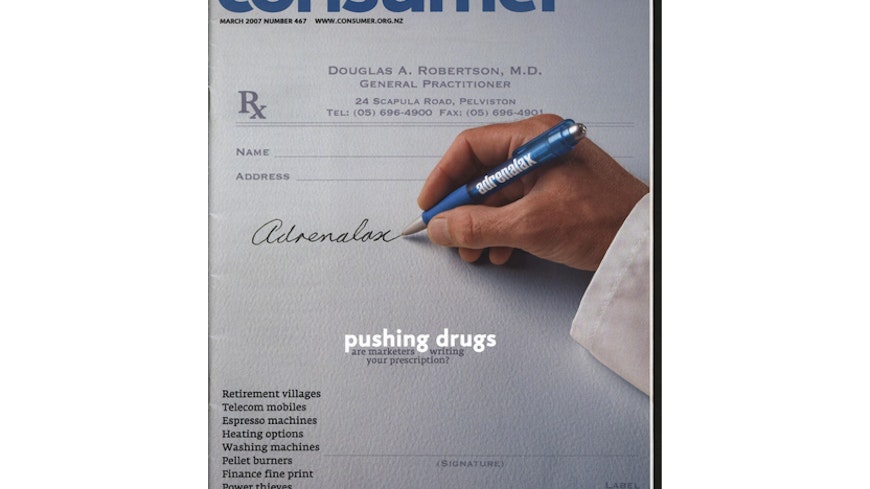

March 2007: Pill pushing

We looked into the impact of drug marketing and the influence it was having on prescribing. Pharmaceutical companies were investing considerable time and money promoting their products, but who was keeping tabs on how this was done? We called for a ban on direct-to-consumer advertising of prescription medicines, slating these ads for failing to provide useful information and downplaying safety issues.

July 2007: Pet spend

We compared the cost of raising a child with raising a “fur kid” (in this case, a dog) for one year from birth. It turned out it was $500 ($620 in today’s prices) cheaper to raise a dog. Total costs for the puppy were $3577 ($4437 today), still a sizeable investment but attractive for one of our staff members who quipped “miles cheaper than a child … and I can leave her by herself all day”.

December 2008: Swimming in it

Sun, surf and … sewage outfalls. Our investigation of water quality found the state of many of our beaches and rivers was enough to make you sick. Of 501 monitored swimming spots, just 17% rated as “very good”. Twenty-nine percent were poor or very poor. This included popular holiday spots such as Gisborne’s Waikanae Beach. In the Waikato, 70% of monitored rivers and streams were unsafe to swim.

August 2009: Rest home roulette

It took six months and a complaint to the Office of the Ombudsman for the Ministry of Health to give us access to rest home audit reports. Many reports made for distributing reading, reporting nursing shortages, assaults on residents by other residents and inappropriate use of restraints – staff in one home used sheets to tie a resident to a bed. To help shed light on standards of rest home care, we called for audit reports to be publicly available – and we got a win.

November 2009: Feathering their nest

Our mystery shop of 33 financial advisers found advice that was scandalously poor. Our expert panel criticised advisers for poor analysis, high costs and bad products. And then there were the advisers who promoted themselves as independent when they weren’t! Only three of the 17 who prepared a financial plan for our mystery shoppers did a good job. The rest of the plans were rated as “disappointing” or were rejected by our panel. The big problem in this industry: commission-based selling skewing consumer advice.

We can't do this without you.

Consumer NZ is independent and not-for-profit. To help us get a fairer deal for all New Zealand consumers, you can make a donation. We’ll use your contribution to investigate consumer issues and work for positive change.