By Rebecca Styles

Research Lead | Hautū Rangahau

Switching banks may be quicker and easier than you think. There are benefits to be had from jumping ship. However, there may also be costs involved, while the difficulty of comparing rates and fees can make it tricky to know if it’s time to switch.

On this page

- Customer service and trust is lacking, but we still stick with our bank

- Why do people switch banks?

- Is it easy to compare bank fees and service?

- Is it easy to switch banks?

- What if you have a personal loan, term deposit or mortgage?

- How to switch banks

- Our fixes for increasing competition in personal banking

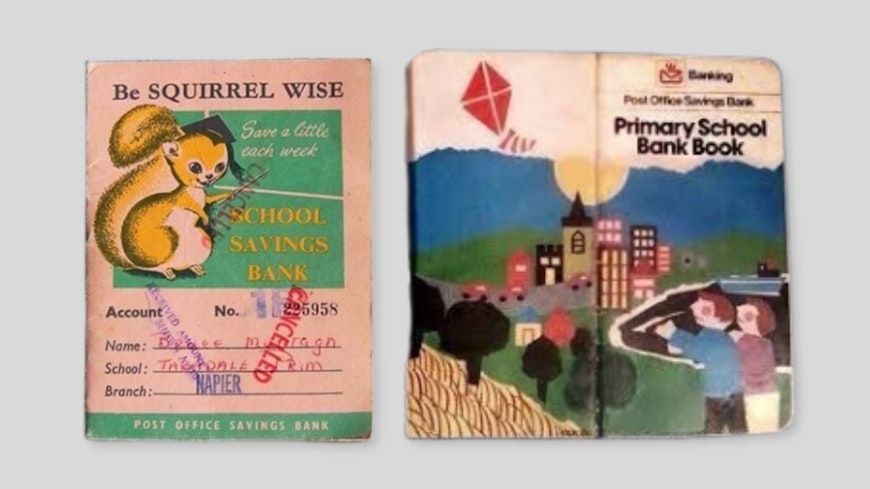

Do you remember school bank books? My Post Office bank book had a thick plastic cover that made a grating noise when you rubbed your fingernails across it. Once a week, I took the book to school with some pocket money – maybe 50 cents – and it would get collected and banked.

Old book banks

School bank books were a great way to instil the saving habit in kids. And in my case, created a customer for life.

I still have the same bank – I’ve never switched. The Post Office was split into three state-owned enterprises in 1987, one of which became the PostBank, and was eventually bought by ANZ in 1989.

I’m not alone in sticking with the same bank. Consumer NZ’s 2024 banking satisfaction survey found only 3% of respondents had changed their bank in the past 12 months. 84% of respondents have been with their bank for 5 years or more.

Yet only 61% of our banking survey respondents are very satisfied with the service they get from their bank. So, why are the rest putting up with lacklustre service?

Customer service and trust is lacking, but we still stick with our bank

Ten percent of respondents reported experiencing a problem with their bank in our 2024 banking survey. Of those, 37% experienced poor customer service.

Other problems included mistakes in processing, wait times to get service and reduced branch availability.

On top of that, trust in banks is low. The April 2024 results of our quarterly Sentiment Tracker showed that just 19% of our respondents thought banks could be highly trusted.

Add to that the public perception that banks are profiting from overcharging customers, and you’d think we’d be changing banks frequently. Instead, there appears to be widespread inertia, and a belief that all the banks are the same and it’s hard to switch.

Instead of switching, it appears people open accounts with a secondary bank. On average, 36% of our respondents had an account with a secondary bank. This could mean people move services around but won’t necessarily change banks completely.

The big banks agree this is what happens. In their submissions to the Commerce Commission’s market study into personal banking services, the big four banks (ANZ, BNZ, ASB and Westpac) suggested customers multi-bank rather than switching completely.

That’s what I’ve done. Although I still have the same bank account for my personal banking, my mortgage and family expenses are with another bank.

Why? Mainly because my partner earned more when we took out our mortgage – so we stuck with his bank.

Why do people switch banks?

The top reason that people changed banks, according to our 2024 banking satisfaction survey, was poor customer service (35%).

It also appears that some customers want all their banking services in one place, with 27% switching to make their main bank the one that holds their mortgage.

High fees (21%) and branch closures (18%) were also pain points which pushed people to find a new bank.

Is it easy to compare bank fees and service?

If you do think your bank’s fees are too expensive, or you want to see whether customer service is better elsewhere, how easy is it to compare?

Unfortunately, there is no one comparison website where all banks’ fees are listed and you can initiate a switch (like PowerSwitch for electricity providers). Instead, people have to go bank to bank to check out the rates – and that only works if all the rates are advertised.

To find out about customer service, Consumer’s annual banking survey includes customer satisfaction ratings. But there are other tools that could be adopted to help New Zealanders evaluate the best bank for them.

Banks in the UK, for example, must display customer satisfaction ratings on their websites, apps and in branches. This is an easy way for customers to see how well a bank treats its clients.

The ratings were brought in as part of the UK’s retail banking market investigation in 2016 and have been published over 6 years. The survey method is set and audited by the Competition and Markets Authority (the equivalent to our Commerce Commission).

We think a similar customer service rating in Aotearoa would help people choose a new provider, as well as lift the level of service banks are providing.

Is it easy to switch banks?

There is a perception that it’s hard to switch banks, but our survey results suggest it’s easier than we think.

Of those respondents who had made the switch, nearly 64% said switching was very easy, and another 23% said it was easy. Only 7% thought it was difficult.

How easy it is for you will depend on what your banking needs are. If you have everyday cheque and savings accounts, the switch is easy. All your recurring payments – direct debits and automatic payments – will be transferred to your new account through a single authorisation.

For those with more complex bank needs, it could be more complicated.

What if you have a personal loan, term deposit or mortgage?

We asked the seven banks that feature in our banking satisfaction survey – ANZ, ASB, BNZ, Co-operative Bank, KiwiBank, TSB and Westpac – whether they charged fees for switching personal loans, term deposits and mortgages.

Personal loan

None of the banks charge a break-fee for switching a personal loan to another bank.

Term deposit

It’s a different story for a term deposit.

Banks are under no obligation to agree to break a term deposit. However, they will consider breaking them in special circumstances, such as within the cooling-off period, after the stated notice period, or where there is hardship.

Ending a term deposit early will reduce the interest payable on the investment.

Fixed-term mortgage

Breaking a fixed-term mortgage before the term is up will cost you. Early repayment charges, discharge and legal fees, and even valuation fees may be applied.

In their submissions to the Commerce Commission’s market study into personal banking services, the big four banks (ANZ, BNZ, ASB and Westpac) suggested that most people with a fixed-term mortgage wait until it’s due for renewal before looking for a better deal. That’s because of the legal and other fees involved in breaking early.

Yet, if you’re not happy with your bank or fixed-term mortgage, it could still be worth shopping around to see if a better deal is available. Potentially, any break fees you incur will be covered by the savings you make from switching banks.

A spokesperson for the NZ Banking Association, the industry body for banks in Aotearoa, told Consumer that banks, “work hard to attract and retain customers”, so it’s always worth negotiating interest rates as part of any switch.

Even if you’re not keen to break early, it can still pay to shop around and see what better rates are available.

Professor David Tripe, of Massey University’s School of Economics and Finance, specialises in banking. He suggests homeowners start talking with their bank and the bank they want to switch to as the end of their fixed-rate mortgage period approaches.

Banks will sometimes offer better rates to new customers than to their existing ones. Or you may find your existing bank offers you a competitive deal, once it finds out you’re looking to switch.

Westpac, in its submission to the Commission’s study said, “Competition for new home loan customers is particularly intense and existing home loan customers rolling off fixed term interest periods are generally offered rates that are comparable to those rates offered to new customers given the perceived threat of switching.”

Floating rate mortgage

There shouldn’t be any penalty for early repayment if your mortgage is on a floating rate. However, there may be some fees for discharging your mortgage, set-up fees at the new provider and legal fees. Your new provider may even want a registered valuation.

Your new provider may offer to foot the bill for some of these fees as part of a deal. Otherwise, you’ll need to work out whether the fees you’ll incur will be offset by potential savings with the new bank.

How to switch banks

Get in touch with the bank you’d prefer to be with.

There’s likely a form to fill out and ID needed, but your new bank will sort out your existing direct debits and automatic payments and manage the switching process.

Be aware, it can take up to 5 days to complete the switch. It may be helpful to have a cash reserve while the switch is taking place in case you get caught short.

If you have a mortgage or other loans with your existing bank, it may take longer, especially if you’re breaking a fixed-term mortgage.

The NZ Banking Association spokesperson said that, when it comes to breaking loans or terms deposits, the time needed to complete the switch “will depend on the circumstances involved. This will involve a conversation with your old bank and could be done relatively quickly.”

Our fixes for increasing competition in personal banking

The Commission’s market study is looking into whether personal banking is competitive in Aotearoa.

We think greater competition would benefit consumers. The current low levels of switching among bank customers may be partially due to the view that all the major banks are relatively similar when it comes to the overall banking experience.

Although the Commission’s study is in the preliminary stages, we’ve suggested some fixes for increasing competition and making it easier to switch rates.

We’d like to see an independent comparison website for banking services.

Currently, it’s not easy to compare the different services, rates and fees offered by banks. You need to view each bank’s website if you want to compare. For most of us, finding the time to do that is a barrier to switching.

We think banks should be required to advertise all rates on offer, so customers can make an informed decision.

Earlier this year, media reported that BNZ was offering 4.99% one-year fixed-term home loans for new loans brought to them via brokers. Yet, its advertised rate was 6.45%. We think all rates and fees should be clear and transparent.

Banks should be proactive in ensuring their customers are getting a good deal.

There’s no obligation on banks to make sure they’re providing you with the best rates available. In the UK, however, banks must ensure their products are fit for purpose and provide good value. We think New Zealand banks should do the same.

Customer satisfaction rates should be displayed

Banks in the UK must display customer satisfaction ratings on their websites, apps and in branches. This is an easy way for customers to see how well a bank treats its clients.

Bring in open banking

means it’s easy to securely share your banking data with another provider to get a better deal. This makes it a lot easier to switch banks. It can also pave the way to using innovative apps and services that can save you time and money.

We’re optimistic that open banking will make it easier for new banks to start-up in Aotearoa. However, the process to implement it has been too slow.

Open banking was first mooted here in 2017, and the legislation to ensure people can share their data is being drafted, but is yet to be considered by government. To ensure competition, efforts to get open banking underway need to be fast tracked.

Which bank is best?

We asked consumers to rate satisfaction with their bank. How did yours do?