By Ruairi O'Shea

Former Investigative Writer | Kaituhi Mātoro

Imagine there was technology available that could reduce surcharges, make it easier to detect and prevent scams, and potentially increase gross domestic product by over 2%.

This technology is not a myth. It’s called a real-time payments network and it allows businesses and consumers to transfer money between each other, instantly, 24/7. Better yet, it’s tried and tested, having been rolled out in Japan in the early 1970s.

The bad news is New Zealand’s banking industry is responsible for putting it in place here and has been dragging its feet over doing so for a long, long, time.

What do we have now?

The closest thing consumers in New Zealand currently have to a real-time payments network is the bulk electronic clearing system (BECS). BECS was established in Australia in 1994 and governs a range of transactions people think of as bank transfers – from direct debits and bill payments, to how you receive your salary or pay your friends when you owe them money.

While payments in a real-time payments network are made from one individual’s account to another instantly, payments made through BECS are grouped into batches and sent at intervals dictated by your bank. Generally, banks send these payments every hour or two between 9am and 11pm.

Sending your money through BECS is like taking the bus; it happens when it happens and it’s a bit slower, but it gets you where you need to be in the end.

This may be OK for a direct debit, or for receiving your salary, but it means we cannot use this payment system to buy a coffee or a plane ticket. For these purchases, we generally have to use a payment provider like Visa or Mastercard, and pay surcharges, or a service like POLi, which will potentially breach your bank’s terms and conditions.

Why we need a real-time payments network

Karen Silk is the assistant governor and general manager economics, financial markets and banking at the Reserve Bank of New Zealand. She lays out a compelling case for the importance of a real-time payments network to New Zealand’s economy.

New Zealand’s lack of a real-time network means there is not much competition in the payments market. The narrow range of options comes at a hefty cost to consumers, according to Silk.

“There’s been a significant narrowing in the forms of payments used by consumers. Card payments make up 90% of all payments in New Zealand, and businesses are paying a cumulative total of $1 billion annually to Visa and Mastercard in merchant service fees. Ultimately, the consumer is the person that will wear that cost.”

A transaction made using a real-time network is not only instant but can carry more information than a transaction made using BECS and transfer it instantly. “This makes them safer, because you’re transferring information, and doing verification, at the same time as you’re doing the payment itself,” Silk says. “It can drive a better, safer experience for consumers.”

There is also the negative impact that inefficiencies in our payments system have on businesses and the economy more widely. “The ability to move money in real time is a really key foundation to building a productive economy,” Silk says.

“Immediacy of payment is critical for businesses. It facilitates e-commerce transactions immediately. It reduces the propensity for errors and delays, and it can improve your cash flow because it can support automatic reconciliation of payments. When you’ve got an economy that has the number of small businesses that we have, really good cash flow is critical.”

The potential benefit of a real-time payments network to New Zealand’s economy is staggering. Modelling by the UK-based Centre for Economic and Business Research indicates a potential uplift to New Zealand’s GDP of 2.2%. That’s equivalent to the GDP contribution of the country’s electricity and gas supply.

Who else has real-time payments?

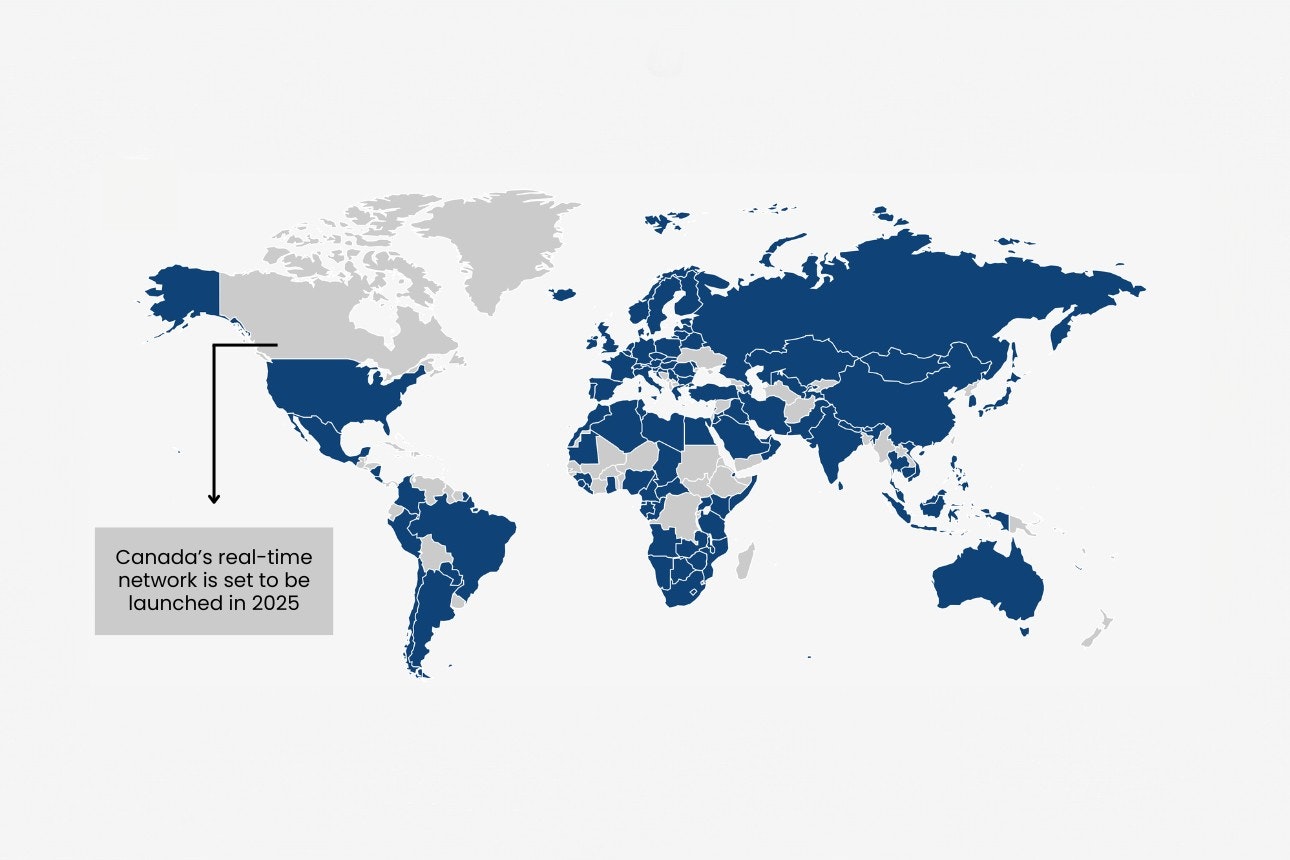

New Zealand has been left behind by the rest of the world when it comes to modern payments infrastructure. It is the only country of the 38 in the OECD that has not implemented, or committed to implementing, a real-time payments network.

Availability of fast payment systems around the world, October 2024

Source: World Bank Global Tracker

Why don’t we have real-time payments?

Consumer NZ believes that New Zealand’s lack of a real-time payments network represents an abject failure by New Zealand’s bank-owned payments governance organisation, Payments NZ, and the banking industry in general.

Payments NZ was formed in 2010; its shareholders are ANZ, ASB, BNZ, Citibank, HSBC, Kiwibank, TSB bank and Westpac. It says the banks are “committed to a progressive self-governing industry that enables Aotearoa to have a world-class payments system”.

But since 2010, our payments system has fallen badly behind the rest of the world. How has that happened?

It’s not because Payments NZ didn’t understand the importance of the technology. In a future-focussed report published in 2015, Payments NZ identified a real-time payments system as a key component of New Zealand’s payments ecosystem in 2025, saying “we are highly confident New Zealand will have fast payment services by 2025”.

Steve Wiggins has been chief executive of Payments NZ since 2014. He puts the failure down to a focus on progressing other forms of modernisation, and on meeting requirements set by regulators.

“There’s always changing priorities as the landscape changes. There was an extent to which we prioritised API standards (to facilitate open banking).”

Yet, banking industries in other nations have managed to successfully implement real-time networks and open banking, all while navigating their regulatory requirements.

So, are there any other reasons?

“Some of the challenge is a reality of capacity and capability,” Wiggins says.

The question of banks’ capacity and capability for innovation is important. In the Commerce Commission’s 2024 market study into retail banking, it was reported that the level of innovation in New Zealand’s banking industry was less than you would expect to see in a competitive market.

That’s because, for years, banks have focussed on maintaining their profit margins, rather than re-investing in our banking infrastructure. This is a choice.

We can see how this plays out in another Payments NZ report from 2015 in which the “business case” for a real-time payments network is described as a significant challenge. Payments NZ quotes a 2014 United States Federal Reserve report, which states that while end users (businesses and consumers) of a real-time network would realise between USD$2–7 billion in benefit, financial institutions would only benefit to the tune of USD$1 billion.

In short, there is widespread agreement that businesses, consumers and the economy will benefit from real-time payments, but the banks only benefit a little bit, so they’ve chosen not to do it.

When will we have a real-time payments network?

In September, Payments NZ opened a consultation on New Zealand’s “next generation payments infrastructure”.

The document lays out something of a roadmap toward a real-time payment network, with Wiggins saying, “We’re now at the point where we’re ready to say, ‘right, when should that occur and how should we introduce that?’”

This is a positive development. You have to start somewhere. But it illustrates just how far behind New Zealand has fallen when it comes to real-time payments. In Australia, it took 5 years from announcing the development of a real-time network to its establishment in 2018. With any similar announcement here likely to follow a lengthy consultation, we are currently further behind on real-time payments than Australia was over a decade ago.

Having failed to meet the prediction of having a real-time payments network in place by 2025, Wiggins now says one should be in place by 2030; 22 years after the UK’s network was launched and 12 years after Australia’s.

Innovation on payments must be mandated

Wiggins describes a real-time network as infrastructure, saying “infrastructure is challenging, whether its road, whether it’s rail. Its complex and we are working through it.”

But like our roads, a real-time network is too important to leave in the hands of an industry that has failed to innovate in line with the rest of the world. If we want to catch-up, government must dictate the pace of change.

When I put it to Wiggins that other countries have innovated much faster than New Zealand, he said, “In the areas you’re looking at, that’s because it’s all been driven by the regulator…we’re industry-led, the regulator hasn’t come in, and that has happened in those other areas that you are describing.”

Here, Silk and Wiggins are on the same wavelength. “If we look internationally, in many cases the development of these systems has actually required governments to mandate their development,” Silk says.

Payments NZ is the body mandated by the banks to run systems that facilitate payments, but it does not have enforcement powers. “They can’t force their participants to bring in real-time payments. They don’t have the power to force it. Overseas, that process of introducing real time payments has been government mandated,” Silk says.

There’s no use crying over spilt milk. Progress on real-time payments is being made, and this will take time. But we must learn from our mistakes.

Our banking industry has proven itself systematically unable to innovate at the same rate as the rest of the world. If we continue to allow the banks to dictate the pace of change, we will fall further and further behind. The banks will maintain their profits, while consumers will pay more for a system which is slower, less competitive and less secure, than those enjoyed by the rest of the world.

It’s time for the government to step in.

Best and worst banks

Every year, we ask New Zealanders about their experiences to find out which bank has the most satisfied customers. How did yours do?