By Ruairi O'Shea

Former Investigative Writer | Kaituhi Mātoro

New Zealand’s major banks report that around $200 million was lost to scammers last year. While you have some protections if someone accesses your internet banking without your permission, when you’re fooled into sending the wrong person your money, you have none.

Yet there is a simple solution – known as confirmation of payee – which can drastically reduce the impact of some scams.

Confirmation of payee was first adopted in the Netherlands in 2017, followed by the UK, with great success. Australian banks are currently testing the technology and their payments should be covered by the technology in 2025.

So, what is confirmation of payee, and when can New Zealanders expect to get this much needed protection from payment scams?

What is confirmation of payee?

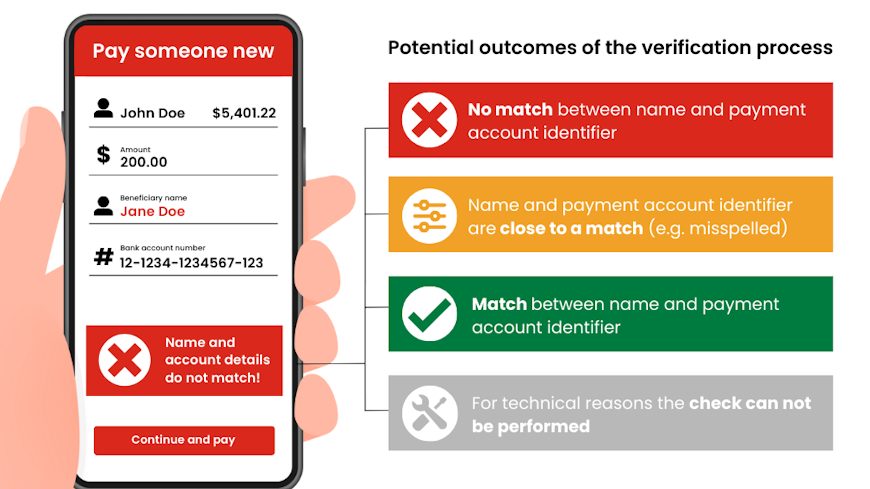

Confirmation of payee means that your bank can check that the name and account details of the person (or business) you intend to pay match the details held by the recipient’s bank, before you make a payment.

For example, if you believe you’re making a payment to a friend, or a business, but the bank account you are sending money to is registered to Mr A. Naughtyman, the confirmation of payee process will flag the discrepancy before you make the payment.

The service is designed to reduce scams that involve authorised push-payments carried out via bank transfers. Authorised push-payments are when a person initiates a payment to a business or an individual. So, in a scam, the person may intend to make the payment, it’s just not going to the place they think. This is as opposed to an unauthorised access scam, which involves a criminal gaining access to a victim’s online banking.

This is not foolproof – scammers can still socially engineer victims into making a payment despite the warning – but the intervention can make you think twice before sending a payment to a scammer. It’s a simple process, but it’s one that can have a significant impact on reducing scams.

How effective is confirmation of payee in reducing scams?

In markets where confirmation of payee has been adopted, the number of payment scams has dropped.

In the Netherlands, the adoption of a confirmation of payee system led to an 81% decline in the number of fraudulent domestic bank transfers.

In the UK, confirmation of payee was first adopted by the country’s six major banks in July 2020, allowing for comparisons with payment service providers that had not yet adopted the technology.

Confirmation of payee quickly drove away scammers. After the first year, the banks using confirmation of payee reported a 10% decline in the total value of authorised-push-payment scams, and a 35% decline in their volume. Yet in the quarter after the system was introduced, banks not using confirmation of payee saw authorised-push-payment fraud increase by more than 60%.

Analysis by PwC said this exemplified “how quickly fraudsters direct their attention to the weakest link”. Further, research conducted in 2022 by the UK’s Lloyds Bank showed that transfers made to firms that were not using confirmation of payee were up to 100 times more likely to be fraudulent although the firm was careful to point out that this difference can’t be attributed exclusively to confirmation of payee.

Following the success of confirmation of payee in the UK, the requirement to use the technology has grown to cover over 400 payment service providers, with over 99% of payments made on the Faster Payments network in the UK covered by the end of 2023.

What’s going on with confirmation of payee in New Zealand?

There’s been a lot of talk, but little action in Aotearoa to get confirmation of payee in place.

In September 2023, the New Zealand Banking Association (NZBA) said that it was instigating an industry-wide confirmation of payee service. In February 2024, the Minister of Commerce and Consumer Affairs, Andrew Bayly, wrote to the NZBA asking for a confirmation of payee service to be introduced, and stating an expectation that the rollout should begin by the end of the year.

The NZBA responded in April, saying that it had selected a technical partner for the service and that banks are “on track to start rolling this out by the end of the year”.

New Zealand, unlike other nations that have adopted confirmation of payee, does not have a modern payments network, and this complicates the rollout of confirmation of payee. It could take some time.

We’ve repeatedly asked the NZBA to estimate a date at which New Zealanders payments will be covered by confirmation of payee, with chief executive officer Roger Beaumont saying, “Rolling out confirmation of payee is not as simple as flicking a switch…It’s difficult to say when the solution will be available for all retail customers until the finer technical details of the solution and an implementation timeline for each bank have been agreed. This work is underway, and we will continue to provide updates as it progresses.”

What can banks do in the meantime?

Until consumers have access to confirmation of payee, they remain vulnerable to authorised-push-payment scams, but banks have no obligation to reimburse victims under the NZBA’s Code of Banking Practice.

In his February 2024 letter to the NZBA, Andrew Bayly recommended the banks investigate a voluntary reimbursement scheme in line with international best practice. In response, the NZBA said that it would review international best practice in this area by the end of September.

Luckily, the UK offers a strong precedent for best practice. There, collaboration between banks and consumer groups led to the adoption in 2019 of a voluntary code of conduct, called the Contingent Reimbursement Model. Under this code, reimbursement is the default outcome, unless banks can prove a customer has acted fraudulently or were grossly negligent. Losses are split 50:50 between the sending and receiving payment services provider.

The code has had a significant impact on reimbursement. In 2018, before the code was put in place, just 23% of losses from authorised-push-payment scams were returned to victims by their banks. By 2022, this figure had increased to 66%.

While this began as a voluntary scheme, from 7 October 2024 it will become mandatory. Meaning in the UK, victims of authorised-push-payment fraud will be protected first by the confirmation of payee system, and then by the reimbursement code.

In Aotearoa today, we have neither.

Our view

Consumer NZ welcomes the NZBA’s instigation of a confirmation of payee system but is concerned there is no timeframe for its implementation.

Consumer NZ chief executive Jon Duffy said, “Banks have finally accepted that name and account matching is necessary to help prevent scams. It’s our view this function should have been implemented before now, and failure to do that means banks have not been adequately protecting their customers.

"We know that the confirmation of payee function won’t prevent all types of scams and that scammers will always look for ways to get round preventative measures, but that doesn’t mean banks and other businesses shouldn’t be doing everything they can to prevent harm to their customers.

“We think that until banks have introduced this technology, they should reimburse anyone who loses money if that loss could have been prevented by name and account number matching.”

We can't do this without you.

As an independent non-profit, we depend on the generous support of our members and donors to keep us fighting for a better deal.