By Ruairi O'Shea

Former Investigative Writer | Kaituhi Mātoro

The Commerce Commission has found that New Zealand’s largest banks do not face strong competition, meaning that banks have been able to sustain high levels of profit despite low levels of innovation. The Commission states that in the medium to long-term, open banking “has the greatest potential to promote ongoing disruptive competition for personal banking services,” and the government agrees.

But what is open banking, and will it drive competition in personal banking?

What is open banking?

Open banking lets you share your banking information with third parties, so you can get the most out of your financial information rather than leaving it exclusively in the hands of your bank. It can be used to facilitate easier switching, make payments without surcharges, and manage money in one place with budgeting apps.

Open banking was initiated in the UK in 2017 by the Competition and Markets Authority (CMA), following an investigation into retail banking. The UK banking sector was dominated by big, established banks, with a lack of difference in services – and a reluctance by consumers to switch providers. This undermined the power of competition to drive improved service.

Sound familiar?

What are the benefits of open banking?

Increased competition through switching

Inertia is a powerful force in personal banking. While many consumers are satisfied with their bank, a lot of us are putting up with an average service. But, according to the latest stats from our banking satisfaction survey, only 3% of respondents have changed their bank in the past 12 months and 84% have been with their bank for 5 years or more.

Whether you want to switch your bank probably comes down to one question – is the financial benefit worth the hassle?

With so little competition in the sector, the hassle of switching often outweighs the financial benefits, but the Commission hopes to change this by introducing open banking.

By giving consumers control of their data, it is hoped that they will happily, and easily, flit from one provider to another to find the best deal. In doing so, the banks would be forced to compete on price to attract consumers.

Consumers can benefit from open data in other areas, too, with the move toward open banking part of a wider shift to help consumers get more from their information. Banking is the first cab off the rank under the Consumer Data Right – legislation which looks to give individuals and businesses greater choice and control over their data – but industries like electricity and insurance could follow.

Improving switching may have been the catalyst for developing open banking, but putting people in charge of their financial data has other practical benefits such as the ability to make payments without surcharges, or to manage disparate bits of financial information all in one place. These applications have been more widely adopted than switching services in the UK.

Reduced surcharges

The services offered by POLi and Windcave are in line with the principles of open banking, but in requiring your log-in information – which your bank says to never, ever divulge – they are something of an informal solution to the problems caused by the absence of open banking. Formalising the ability to pay using services facilitated by open banking will provide consumers with cheaper, safer ways to spend their money.

In addition to facilitating safer, cheaper payments for consumers, this development creates spaces in which new financial technology companies (also known as fintechs) can enter the financial arena in New Zealand, providing further competition for the services offered by banks.

Managing all your finances in one place

Prior to open banking, if consumers in the UK wanted an understanding of their overall financial position, they would need to gather a wide range of information from banks and other financial providers, as well as from their utilities and telco providers and any other subscription services they may have.

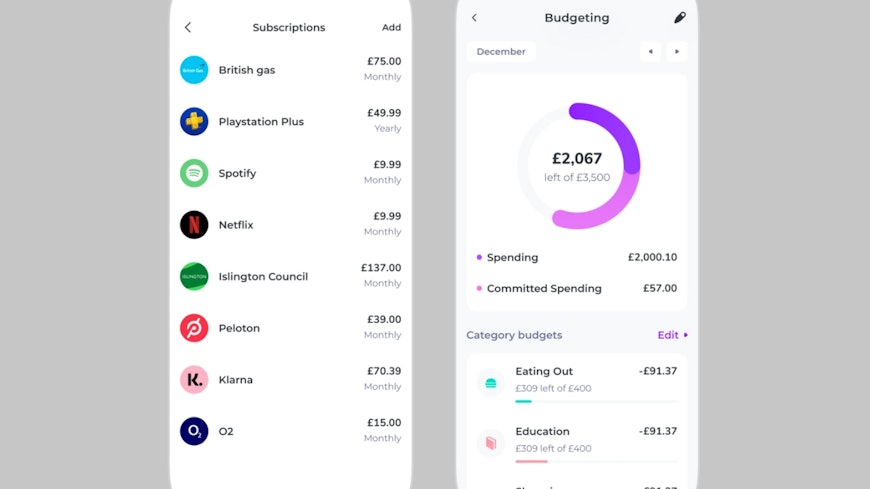

Today, UK consumers can instruct their bank to allow third parties access to this information, where it can be analysed and pulled together in a user-friendly interface. This has prompted the development of a wide range of services that can help consumers better understand and manage their money.

A screenshot of the open banking facilitated app Emma which offers consumers a holistic view of their finances at a glance, by pulling together financial information from a range of sources.

Our counterparts at Which? in the UK have pulled together a list of the best budgeting apps facilitated by open banking which provide a flavour of one way in which open banking can improve the consumer experience.

These services can in turn increase the value proposition offered by banks. If a consumer wants to use one of these services, but their bank cannot facilitate it, it may provide another reason to switch bank. Further, in the UK, new banks like Monzo have put these features at the centre of their services, forcing the incumbent banks to innovate to keep up.

Are there any risks?

Open banking is a largely a consumer-driven piece of legislation, redressing the balance of power between consumers and banks when it comes to financial information.

However, while the benefits outweigh the drawbacks, risks remain.

While standards have been put in place to ensure high standards of data security, breaches can happen. The more parties you grant access to your personal information, the more points of vulnerability you create.

Importantly, the status quo is not risk-free. At present, if you want to pay a business without surcharges, POLi and Account2Account may be your only options, but they are not covered by your bank’s terms and conditions. If you think you are dealing with POLi, but you’re actually using a copycat website, you could lose your money while sacrificing the little protections your bank does offer.

What does the market study mean for open banking in New Zealand?

The Commission’s market study is withering in its assessment of the major banks and their implementation of open banking, saying that “Progress towards open banking in New Zealand has been too slow because the major banks have been left to set the nature and the pace of change.”

“As a result, New Zealand consumers are missing out on the competition and innovation open banking can provide.”

The Commission has identified open banking as having “the greatest potential to promote ongoing disruptive competition for personal banking services” in the medium to-long term, with the report stating that industry and the government should commit to ensuring that open banking is fully operational by June 2026.

To do this, the market study has recommended that industry and the government “commit to delivering a series of ambitious milestones by June 2026 to ensure open banking’s full potential is realised.” In addition to committing to the delivery of open banking by 2026, the market study recommends that the government should support open banking by being an early adopter, meaning that consumers would be able to pay taxes or vehicle licencing through open banking.

In the report, the Commission states that it sees “no reason why New Zealand can’t learn from, and leapfrog, progress in other jurisdictions” on open banking. It goes on to say it sees greater potential for uptake of open banking in New Zealand than in the UK because fintechs have had time to develop ideas, products and innovations, and to learn from overseas success.

This might be true, but New Zealand’s banking industry has displayed such little appetite for innovation in the last two decades that the government has had to step in in the first place. By the time open banking is available to consumers in New Zealand, consumers in Britain will have been using it for almost a decade.

Which bank is best?

We asked consumers to rate satisfaction with their bank. How did yours do?