By Kate Harvey

Content Manager | Pou Whakahaere Ihirangi

You’ve probably had an email from your bank in the last few weeks letting you know it’s rolling out the confirmation of payee (CoP) service. CoP requires you to check that account names and numbers match before making a payment – so you don’t mistakenly pay the wrong person or a scammer.

Although we’re pleased New Zealand banks are rolling out this system, the move highlights how much our banks’ protection systems are lagging – the Netherlands rolled out this technology in 2017. Scammers are getting smarter, and our banking protection systems need to keep up.

New Zealand Banking Association chief executive Roger Beaumont said banks are using a “phased approach” to rolling out CoP, with the goal of having it available across all online personal banking services by Easter 2025.

“For customers, this means confirmation of payee might not be available across all online banking platforms simultaneously. They might find that a confirmation of payee check is available from some banks and not others, alternatively it might be available on your desktop banking platform but not your mobile app, or vice versa,” Beaumont said.

Here's what you need to know about making and receiving payments online now that CoP is being rolled out.

How making a payment will change

When you make an online payment into a New Zealand bank account, you’ll now have to enter the account holder name – and it needs to be accurate. This means you’ll need to ask the person you’re paying for this information.

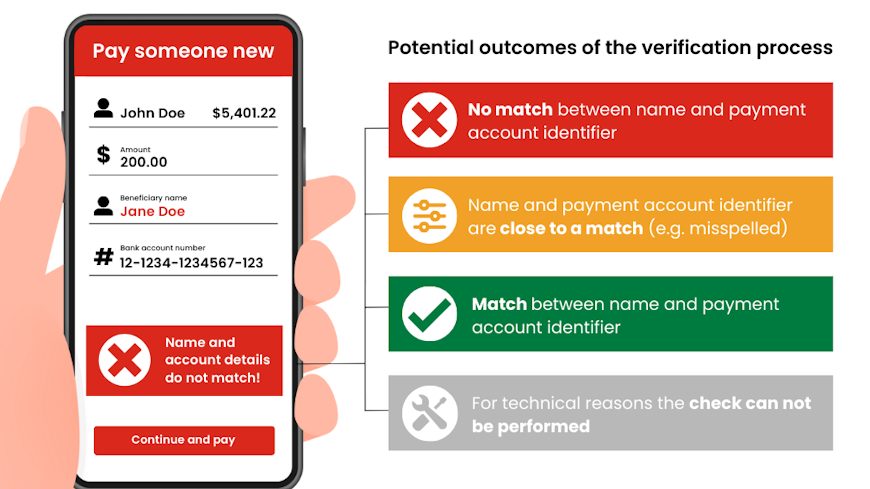

Previously, you might have come up with your own name for the payee. Now you’ll need to use the full name that’s registered to the account. The CoP service will then check the account holder name against the bank account, and you’ll get a notification.

The notification will be different depending on your bank but is likely to look something like this:

Even with CoP in place, you should take a moment to consider whether you’re paying a legitimate person you trust.

There are some payments that won’t get a CoP check, including making a payment to:

someone you’ve already saved as a payee

an overseas bank account

organisations such as councils and utilities companies that are registered with Payments NZ – the payment industry’s governance body

How getting paid will change

In the past, in order to be paid, you might have only shared your bank account number. Now you must also share the name registered to that account.

You should be able to find your account’s registered name when you’re logged into online banking. Banks are also publishing information on their websites about how to find your account name. You might want to check now that you’re happy with the name registered to your account. You can contact your bank if you’d like to change it.

CoP is great – but we want more

CoP is just one small step towards protecting consumers from scammers. We think banks should be doing so much more.

The initial findings of the Commerce Commission's market study into personal banking confirm that the major banks have been focused on maintaining profit margins, leading to underinvestment in other important areas.

In 2023, New Zealand banks reported record profits, totalling to $7.21 billion after tax. Some of these profits could, and should, have been reinvested in scam prevention measures and victim reimbursement.

Total scam losses in New Zealand for 2023 came to around $200 million, which is about 2.8% of the banks' collective profits. Our banks can afford to deal with this.

If you think more needs to be done to protect your money, sign our Stamp out scams petition.

So far, nearly 13,000 people have signed the petition: we’re aiming for 20,000. We’re calling for:

banks to refund scam victims for authorised and unauthorised scam payments, unless the victim has been grossly negligent

the development of a national anti-scam framework, requiring banks, telecommunications companies and digital platforms to take action to address scams and outlining their liability if they fail to meet their obligations

the creation of a centralised anti-scam centre, where relevant organisations work together to keep us safe.

Stamp out scams

Scams are on the rise, with over a million households in NZ targeted by scammers in the past year. Help us put pressure on the government to introduce a national scam framework that holds businesses to account.